Opening Growth Possible: Bagley Risk Management Approaches

Opening Growth Possible: Bagley Risk Management Approaches

Blog Article

Secret Aspects to Take Into Consideration When Choosing Animals Threat Defense (LRP) Insurance Policy

When assessing choices for Livestock Risk Protection (LRP) insurance, a number of vital aspects warrant careful consideration to make sure efficient danger administration in the agricultural field. Picking the best coverage choices tailored to your details livestock procedure is paramount, as is recognizing how superior prices associate with the level of security offered. In addition, the qualification requirements for different sorts of animals and the flexibility of the plan to adapt to transforming circumstances are critical elements to weigh. The performance and transparency of the cases process can dramatically affect the general experience and financial end results for animals producers. By tactically navigating these vital elements, producers can safeguard their investments and alleviate potential threats successfully.

Protection Options

When taking into consideration Livestock Danger Defense (LRP) insurance, it is necessary to recognize the various protection options offered to mitigate risks in the agricultural sector. Animals Threat Defense (LRP) insurance uses various coverage alternatives tailored to satisfy the diverse requirements of livestock manufacturers. Bagley Risk Management. One of the main insurance coverage options is cost protection, which protects versus a decrease in market prices. Manufacturers can pick the coverage degree that straightens with their rate threat monitoring objectives, enabling them to secure their operations against potential financial losses.

One more important insurance coverage alternative is the endorsement duration, which figures out the length of time the insurance coverage is in impact. Producers can pick the endorsement period that finest suits their manufacturing cycle and market conditions. Additionally, insurance coverage levels and prices vary based upon the kind of livestock being guaranteed, giving manufacturers the flexibility to tailor their insurance coverage plans according to their certain demands.

Recognizing the various coverage alternatives available under Animals Danger Protection (LRP) insurance coverage is important for manufacturers to make educated choices that effectively protect their animals operations from market unpredictabilities.

Premium Prices

Livestock Threat Defense (LRP) insurance coverage offers vital coverage options customized to reduce risks in the farming market, with a considerable aspect to take into consideration being the computation and structure of premium prices. These include the type and number of animals being insured, the coverage degree selected, the existing market costs, historical rate data, and the size of the protection period.

Insurance companies analyze historical information on animals prices and production expenses to establish an appropriate premium that shows the degree of threat entailed. It is important for animals manufacturers to meticulously review premium costs and protection choices to guarantee they are appropriately protected against potential financial losses due to unfavorable market problems or unanticipated occasions.

Qualified Animals

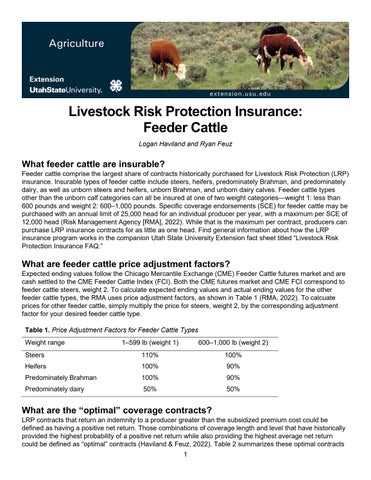

The resolution of qualified livestock for Animals Danger Protection (LRP) insurance protection includes careful factor to consider of certain criteria and characteristics. Animals types that are typically qualified for LRP insurance coverage include feeder livestock, fed cattle, swine, and lambs.

Feeder livestock, for example, are frequently eligible for LRP protection if they drop within specified weight varieties. Lambs are another classification of animals that can be considered for LRP insurance coverage, with factors such as weight and age playing a vital role in establishing their eligibility.

Prior to picking LRP insurance for animals, producers need to carefully evaluate the qualification standards outlined by the insurance coverage supplier to guarantee their animals meet the required demands for insurance coverage.

Plan Flexibility

Policy versatility in Livestock Danger Defense (LRP) insurance allows producers to tailor insurance coverage to match their specific needs and risk management techniques. This versatility equips animals manufacturers to tailor their insurance coverage based on factors such as the type of livestock they own, market conditions, and individual danger tolerance Click This Link levels. One crucial aspect of policy home adaptability in LRP insurance policy is the capacity to pick insurance coverage degrees that line up with the producer's financial objectives and risk direct exposure. Producers can select insurance coverage levels that protect them versus possible losses due to variations in animals prices, guaranteeing they are sufficiently insured without overpaying for unneeded protection. Additionally, LRP insurance supplies adaptability in policy period, permitting producers to pick insurance coverage periods that ideal fit their manufacturing cycles and advertising timelines. By offering personalized choices, LRP insurance makes it possible for producers to successfully manage their risk direct exposure while protecting their animals operations versus unexpected market volatility.

Insurance Claims Refine

Upon experiencing a loss or damage, producers can start the claims process for their Livestock Danger Protection (LRP) insurance coverage by immediately contacting their insurance coverage service provider. It is vital for manufacturers to report the loss as soon as possible to accelerate the cases procedure. When getting to out to the insurance company, manufacturers will certainly require to give thorough information about the event, including the date, nature of the loss, and any kind of relevant documentation such as veterinary records or market costs.

After the assessment is full, the insurance policy supplier will certainly decide pertaining to the insurance claim and interact the outcome to the manufacturer. The producer will get settlement according to the terms of their Animals Risk Security (LRP) insurance coverage plan if the claim is authorized. It is essential for producers to be aware of Visit Website the insurance claims procedure to make certain a smooth experience in the event of a loss

Final Thought

In final thought, when choosing Livestock Risk Defense (LRP) insurance policy, it is important to take into consideration insurance coverage alternatives, premium expenses, eligible animals, plan versatility, and the insurance claims process. These key variables will certainly assist guarantee that ranchers and farmers are appropriately shielded against potential threats and losses linked with their livestock operations. Making an educated decision based on these factors to consider can eventually lead to far better monetary safety and security and comfort for animals producers.

Animals Risk Defense (LRP) insurance coverage offers different protection options tailored to meet the diverse requirements of livestock producers.The decision of eligible animals for Livestock Danger Protection (LRP) insurance policy coverage involves cautious factor to consider of specific standards and features.Policy flexibility in Animals Danger Security (LRP) insurance permits manufacturers to tailor coverage to suit their certain requirements and risk monitoring techniques.Upon experiencing a loss or damages, producers can start the claims procedure for their Animals Threat Defense (LRP) insurance by without delay calling their insurance coverage company.In conclusion, when choosing Animals Risk Defense (LRP) insurance, it is necessary to consider coverage alternatives, premium costs, qualified animals, policy flexibility, and the insurance claims process.

Report this page